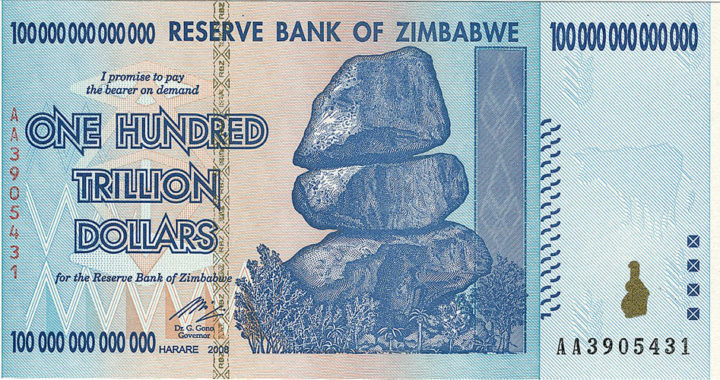

Zimbabwe experienced a currency crisis that initially began as a series of high-rate inflations in the late 1990s. This eventually led to hyperinflation occurring from 2008 to 2009. Prices spun out of control, with an inflation rate of 48 percent in 1998, and reached an astonishing 79.6 billion percent in November 2008. Consequently, in an attempt to address the crisis, the government introduced a 100-trillion-dollar Zimbabwean dollar note in 2008. This proved futile as it could not buy even a roll of bread. The country then discontinued the use of its own currency in 2009 and adopted foreign currencies like the euro and the U.S. dollar

Currency Crisis: Exploring and Understanding the Causes of Hyperinflation in Zimbabwe

1. Economic Crisis: Fundamental Causes of Inflation and Hyperinflation Due to Problems in the Economy

The inflation and subsequent hyperinflation in Zimbabwe were consequences of more specific problems unfolding within its economy. Zimbabwean economists Arnold M. Chidhakwa and Gibson Chigumira mentioned that the country had a vibrant and diversified manufacturing industry in the early 1980s. It even had the potential to become one of the newly industrialized economies alongside South Africa in the late 1980s. However, because of underinvestment and counterproductive interventionist policies of the government that negative its growth potential, an economic crisis ensued.

Chidhakwa and Chigumira further highlighted that the fiscal position of Zimbabwe started deteriorating in the early 1990s. This decline was attributed to budget deficits resulting from several factors, including escalating civil service wages and salaries, excessive spending on social services, relief programs during drought periods, and losses incurred by state-owned enterprises. Industries and sectors, as well as subsidized credits, became inefficient due to their dependence on the ownership and control of the state

Real gross domestic product or GPD declined to 1.4 percent in 1997 from a GDP of 9.7 percent in 1996. It plummeted further to negative 4.8 percent in 2001 due to rising costs of production, weakening domestic demands because of decline in the income of the consumers, foreign exchange shortages, budget deficits, and expanding debt obligations.

A report from the Federal Reserve Bank of Dallas authored by Janet Koech also noted that the participation of Zimbabwe in the Second Congo War that spanned from 1998 to 2002 resulted in unexpected expenditures amounting to hundreds of millions of dollars. Furthermore, starting in 1999, the country began to default on its debts owed to the International Monetary Fund, the World Bank, and the African Development Bank.

Zimbabwe experienced a surged in the number of people leaving the country and relocating to neighboring countries. This wave of emigration resulted in a decline in the labor force starting in 2003. Approximately 6 percent of the total population emigrated in 2005. The figure rose to 9.9 percent by 2010. The wave of emigration reflected a substantial portion of the population seeking opportunities and stability outside of Zimbabwe. This contributed further to the economic and social challenges faced by the country.

The worsening economic situation set the stage for inflationary conditions. The country had no leverage to keep prices in check. It was vulnerable to hyperinflation due to its weak economy. It can be argued that the looming economic problems represent on one of the main causes of hyperinflation in Zimbabwe. Moreover, at the same time, hyperinflation worsened further the economic situation and plunged the country even deeper into the crisis.

2. Agricultural Collapse: Specific Causes of Inflation Due to a Decline in Agricultural Productivity and Supply

Following the election of Robert Mugabe in February 1980 as the first prime minister of Zimbabwe, in addition to its independence from the United Kingdom in April of the same year, the government introduced land reform initiatives centered on equally distributing lands between white Zimbabweans of European ancestry and black subsistence farmers. The efforts proved to be ill-conceived due to their determinate consequences.

A 2010 report from the United Nations identified critical problems within the land reform initiatives of the government. These included forceful confiscations of lands from white owners without proper compensation, inadequate management of territorial disputes, and enduring shortages of resources required for effective resettlement.

Productivity within the agricultural sector eventually declined due to two significant factors. First, according to several analyses, including an article published in the Florida Journal of International Law, agricultural output dropped because the new farmland owners. In particular, primary black landowners and their families, who had strong ties to the government, had no experience in running farms. The same article explained that white landowners used economies of scale to raise capital, improve farming operations, and raise production outputs.

The second contributing factor pertained to natural causes. Adverse weather conditions and recurring periods of drought had a detrimental impact on agricultural output. Hence, with inexperienced landowners and farmers, productivity fell by 50 percent from 2000 to 2009. Export revenues and foreign reserves declined also declined since Zimbabwe was one of the largest producer and exporter of tobacco in the world.

The country also experienced starvation and famine due to food shortages. The prevailing food insecurity resulted in inflation. Prices of agricultural produces and other food products increased due to inadequacy of food producers to meet existing demand. The series of price increases also affected the prices of other goods and services because of the important and influential role of agriculture and food supply in the entire economy.

It is also important to factor in other pressing problems in the economy to include inefficient markets due to interventionism and budget deficits because of excessive government expenditures. The Mugabe government tried to impose price controls to preserve or improve the purchasing powers of the consumers. These measures turned out to be damning. They worsened the productive capabilities of enterprises and resulted in shortage of supplies amidst existing levels of demands. Price increases became uncontrollable.

3. Overprinting of Money: From Inflation to Hyperinflation Due to the Excessive Growth of Money Supply

The Mugabe government opted to address the economic crisis and persisting inflation by increasing the supply of money in circulation through the printing and introduction of additional banknotes. Analysts widely attribute this decision as the primary cause of hyperinflation in Zimbabwe. Chidhakwa and Chigumira mentioned that money supply grew at an average of 17.5 percent between 1980 and 1985. The supply further grew by 46.7 percent in 1993 and 102.7 percent in 2001. They explained that the expansion of the money supply was not a suitable action in the face of declining economic activity and stunted economic growth.

An expansionist fiscal policy through excessive government spending was developed and deployed to stimulate the economy. The government embarked on large-scale public projects, such as infrastructure development and social programs, without adequate funding or sustainable revenue sources. Excessive spending resulted in budget deficits that were financed through the printing of additional banknotes and borrowing from the central bank.

Other reports highlighted other reasons for the growth of money supply. A BBC report noted that the Zimbabwe participated in the Second Congo War as part of its attempt to reap long-term financial rewards from its relationship with the Democratic Republic of Congo. The country financed its wartime involvement by printing more money to provide its army and government officials with higher monetary incentives.

Another reason behind the overprinting of money was corruption. Economists Mark. J. Ellyne and Michael R. Daily mentioned that the Mugabe government deliberately increased the money supply to finance its political activities and expand further patronage networks. This included funding the security forces, supporting political campaigns, and providing financial assistance to loyalists. Mugabe won the favors of different political allies and other sociopolitical factions by keeping them under the payroll of the government. These practices were not backed by real economic productivity or revenue-generating activities.

Monetary expansion leads to hyperinflation because there is more money chasing a limited supply of goods and services. Excess liquidity creates a situation where the demand outstrips the available supply. High demand and low supply results in high prices. Furthermore, because people anticipate possible price increases in the future, they are more prone to expand their consumption activities, thus increasing the demand further.

Excess money supply through deliberate overprinting has been regarded as one of the main causes of hyperinflation in Zimbabwe. However, considering the reasons behind the monetary expansion policies of the Mugabe government, it can also be considered that poor governance and corruption are also an important factor in understanding how and why the country has experienced one of the worst case of hyperinflation in history.

4. Global Crisis: Exposure to Widespread Problems Affecting the World and Their Impact in the Local Economy

The Mugabe government started to adopt foreign currencies including the United States dollar, the euro of the European Union, and the South African rand beginning in 2008 to facilitate commerce. It also stopped printing its local currency in 2009. The removal of Mugabe from office in 2017 allowed the new government to implement economic reforms. Zimbabwe experienced a single-digit inflation rate in 2018.

However, beginning in 2019, as the country began the conversion from foreign currencies to a new Zimbabwean currency, hyperinflation resurfaced. Estimates suggest that inflation reached 500 percent during the same year. Several economists explained that the issuance of banknotes of higher denominations or proclamation of new currency regimes will not solve hyperinflation in the country because its government never included a believable basis for monetary stability. People have more confidence in foreign currencies.

The situation worsened beginning in 2020. The coronavirus pandemic that started in end of 2019 and worsened beginning in the second quarter of 2020 had a negative impact in Zimbabwe. Economic growth affected because several businesses were forced to close or operate at a reduced capacity. Unemployment also rose from 7.9 percent in 2019 to 10.3 percent in 2020. The pandemic also resulted in an increase in poverty.

Another global event that affected the domestic economic and resulted in the resurgence of hyperinflation in Zimbabwe was the escalation of the Ukraine-Russia conflict beginning in February 2022. The geopolitical crisis has a significant impact on the global economy because of its specific impact in the prices of oil and gas in the global market and the importation of valuable products like agricultural produces from Ukraine.

Inflation in Zimbabwe increased from 540 percent in February 2020 to 676 percent in March 2020. It experienced another period of high inflation in 2022 at 131 percent in March and 191 percent in June of the same year. The coronavirus pandemic and the aforementioned geopolitical conflict had resulted in the 2021-2023 Global Inflation Surge and the 2021-2022 Global Supply Chain Disruption. These global economic events had a significant impact on the prices of goods and services Zimbabwe because they made imported commodities and products more expensive while also contributing to shortages in supplies.

Conclusion: The Factors of Hyperinflation Based on the Experience of Zimbabwe

There were two primary causes hyperinflation in Zimbabwe. The first revolved around economic problems that stemmed from unsuitable economic policies and resulted in the reduction of economic activities and productivity. The second centered on a monetary policy involving the overprinting of money or excessive growth of money supply. Both of these causes also stem back further to the inefficiencies of the Mugabe government.

More specific causes include state interventionism that resulted in lack of competition and market failure, damning land reform initiatives, participation in the Second Congo War, failure in managing public finances, a decline of exports and dependence on imports, price controls that exacerbate shortages, impacts on factors of production, and political stemming from oppositions to the Mugabe administration.

Two theories of inflation can provide further insights into the causes of hyperinflation in Zimbabwe. The first is the concept of demand-pull inflation. This explains that prices naturally rise when the demand for goods and services outpaces the supply or when consumption activities outpace the productive capacity of producers. Remember that there was a decline in economic productivity in Zimbabwe due to problems in the agricultural sector and overall economic mismanagement that spilled out to other sectors and industries.

Furthermore, in the secondary cause, a monetarist theory of inflation explains that price increases transpire when there is an excessive growth of the money supply. It is important to note that excess supply of money in circulation means that there is more money competing for the same number of goods and services. The Mugabe government overprinted banknotes without regard for the long-term consequences of uncontrolled monetary expansion.

The cause of hyperinflation in Zimbabwe boils down to governance issues. The government did not have the right capabilities to manage the economy. It was also a corrupt government. Remember that corruption affects economic development and can also result in widespread poverty. The problems created by Mugabe and his cohorts were too deep that the country still experiences resurgence of hyperinflation despite attempts at reforms.

FURTHER READINGS AND REFERENCES

- 2000, July 25. “Mugabe’s Costly Congo Venture.” BBC. Retrieved online

- Chidhakwa, A. M. and Chigumira, G. 2016. “Pre-Crisis Macroeconomic Performance and Triggers of the Economic Crisis in Zimbabwe.” In eds. G. Kararach and R. O. Otieno, Economic Management in a Hyperinflationary Environment: The Political Economy of Zimbabwe, 1980-2008. Oxford: Oxford University Press. ISBN: 978-0-19-874750-5

- Dancaescu, N. 2003. “Note: Land Reform in Zimbabwe.” Florida Journal of International Law. 15:615-644

- Ellyne, M. J. and Daly, M. R. 2016. “Zimbabwe Monetary Policy: From Hyperinflation to Dollarization.” In eds. G. Kararach and R. O. Otieno, Economic Management in a Hyperinflationary Environment: The Political Economy of Zimbabwe, 1980-2008. Oxford: Oxford University Press. ISBN: 978-0-19-874750-5

- J. 2011. “Hyperinflation in Zimbabwe.” Globalization and Monetary Policy Institute: 2011 Annual Report, Federal Reserve Bank of Dallas. Federal Reserve Bank of Dallas. PDF

- United Nations Country Team, Zimbabwe Government. 2010. Country Analysis Report for Zimbabwe. Harare: United Nations Country Team